Social Security Tax Limit 2025 Withholding - Maximum Social Security Tax 2025 Withholding Means Viole Lenora, In 2025, only the first $168,600 of your earnings are subject to the social security tax. Beyond that, you'll have $1 in social security withheld for every $2 of. Social Security Tax Limit 2025 Withholding Chart Peg Martguerita, Only these percentages can be withheld. (for 2023, the tax limit was $160,200.

Maximum Social Security Tax 2025 Withholding Means Viole Lenora, In 2025, only the first $168,600 of your earnings are subject to the social security tax. Beyond that, you'll have $1 in social security withheld for every $2 of.

So, if you earned more than $160,200 this last year, you didn’t have to.

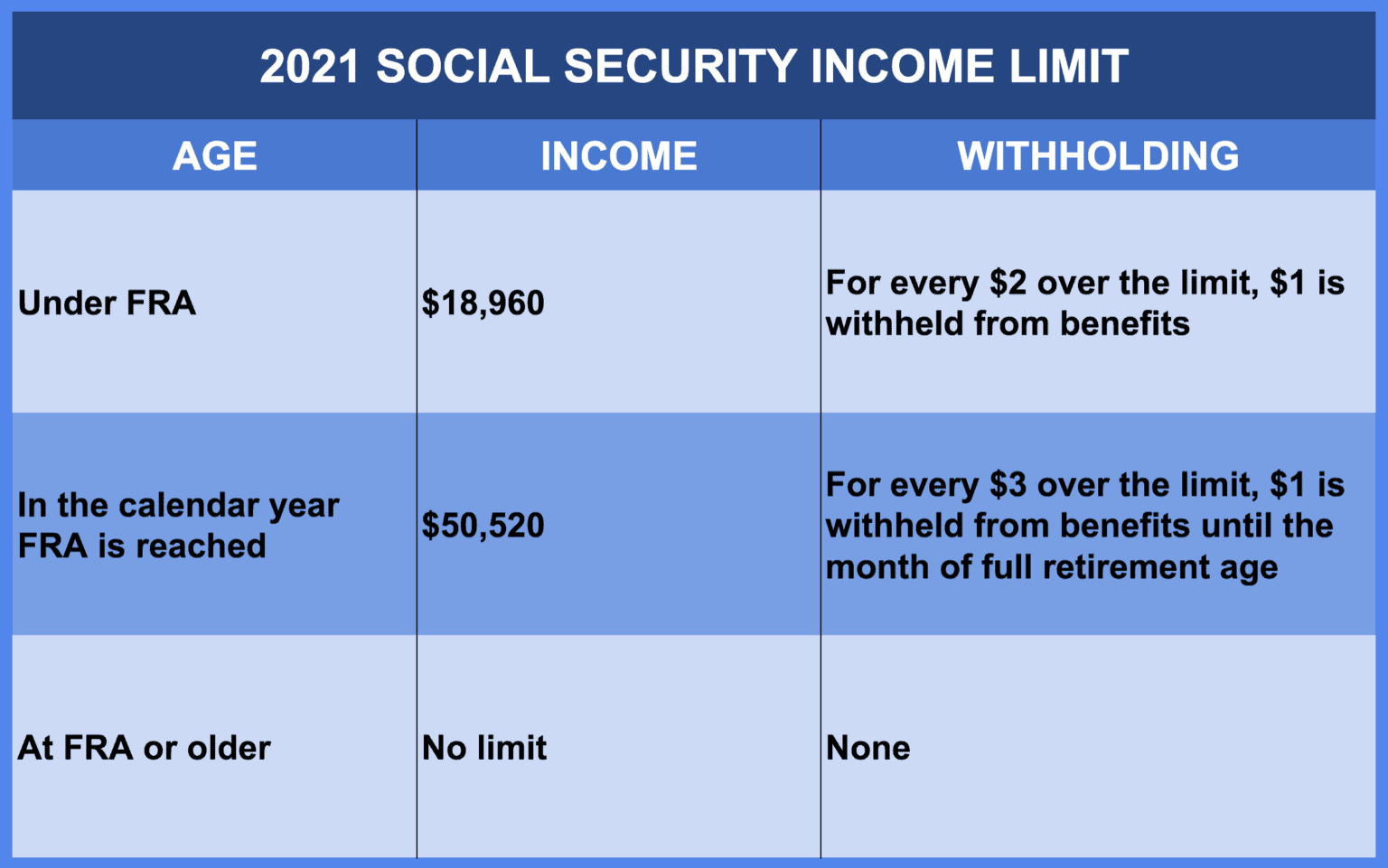

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security. You file a federal tax return as an individual and your combined income is more than $34,000.

Maximum Social Security Tax Withholding 2025 Married Hildy Karrie, This is up from $9,932.40. This amount is known as the “maximum taxable earnings” and changes each.

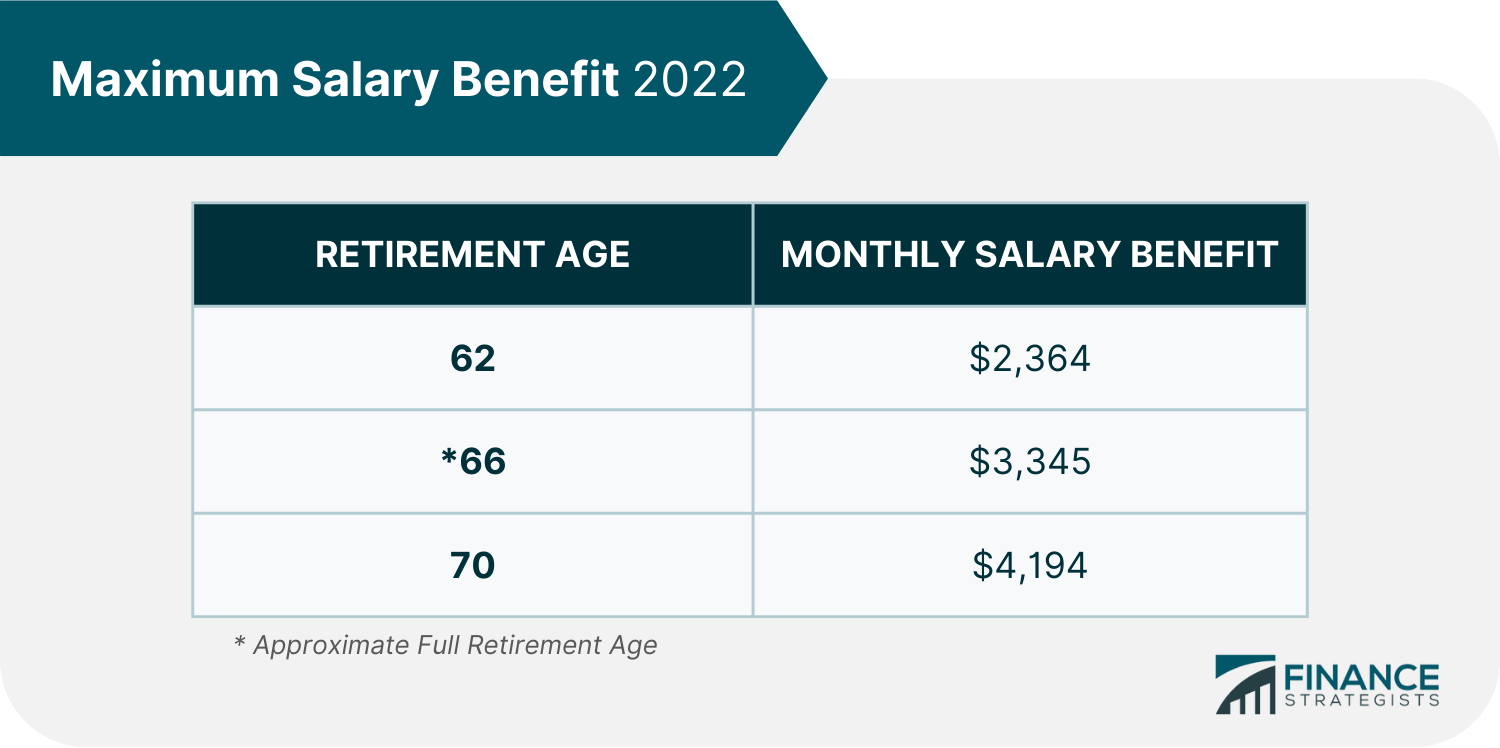

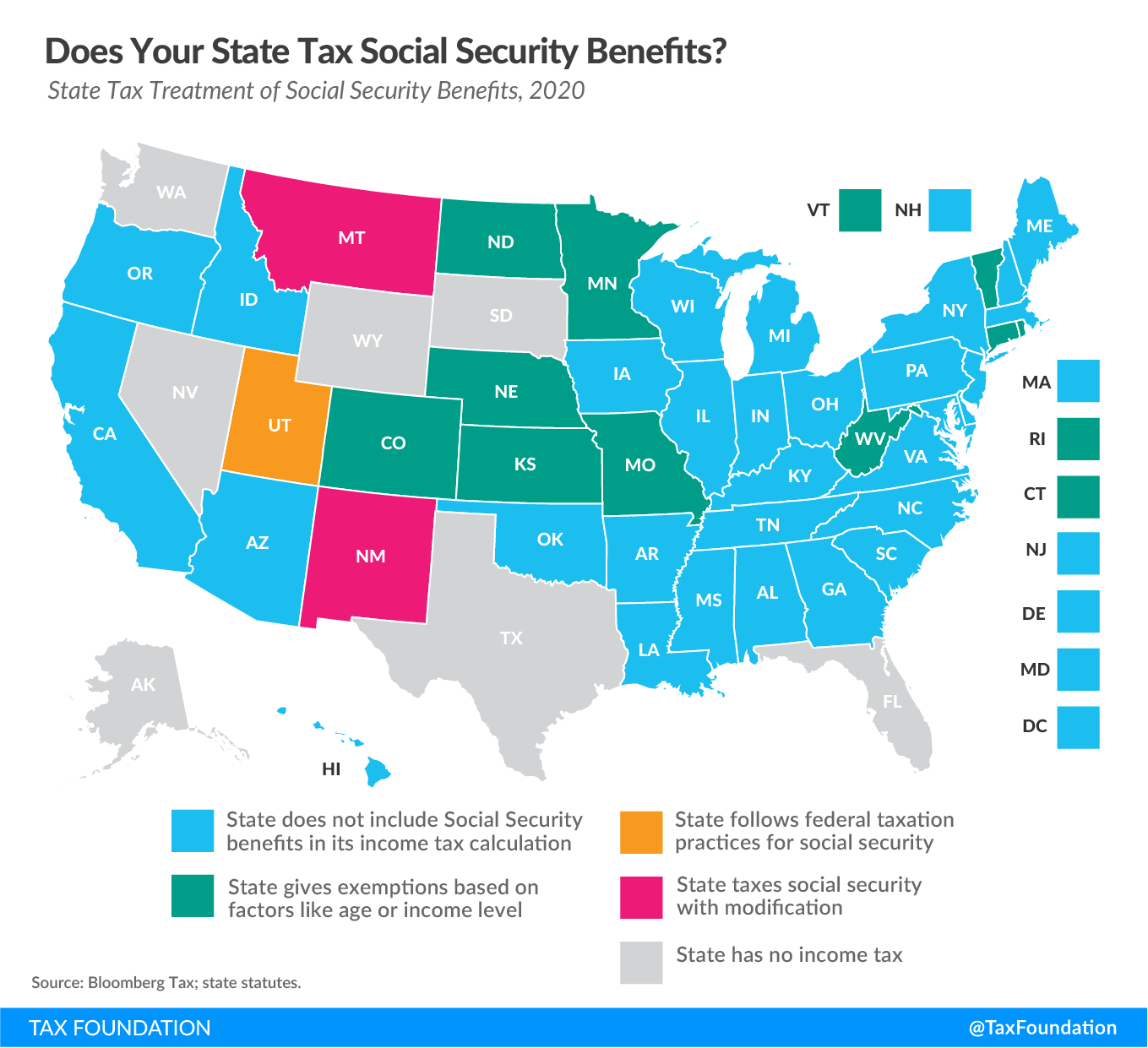

What'S The Max Social Security Tax For 2025 Maris Shandee, For 2025, the social security tax limit is $168,600. How retirement income is taxed by the irs;

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. The maximum amount of income that's subject to the social security tax is $168,600 in 2025.

Maximum Withholding Social Security 2025 Marty Hendrika, Five things to know about social security and taxes; Generally, each employer for whom you work during the tax year must withhold social security tax up to the annual limit.

Social Security Tax Limit 2025 Withholding. This amount is known as the “maximum taxable earnings” and changes. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase.

2025 Neet Paper. Neet biology exam pattern 2025 is now released by the national testing agency (nta). Neet mds paper analysis provides an overview and […]

Your wages are taxed at 1.45% for medicare and there’s no limit on earnings. You file a federal tax return as an individual and your combined income is more than $34,000.